Many are wondering what impact the developing Ukraine situation will have on the stock market and if they should re-position their portfolios.

The primary issue driving stock market uncertainty is worry about the question of transience of inflation and how far interest rates will rise, which the market has been actively discounting since early January of this year, as it waits for more data in the coming weeks and months.

Right now, though, we have the Ukraine uncertainty. Having lived through not a few similar situations in my 35+ year career and seen first-hand what happens, there is usually an immediate downward reaction; but the market typically recovers, often very quickly, as ultimately, it is a question of how any military/geopolitical conflict affects our economy and individual company’s prospects: the answer is that it usually doesn’t, and if it does, it is often short-lived.

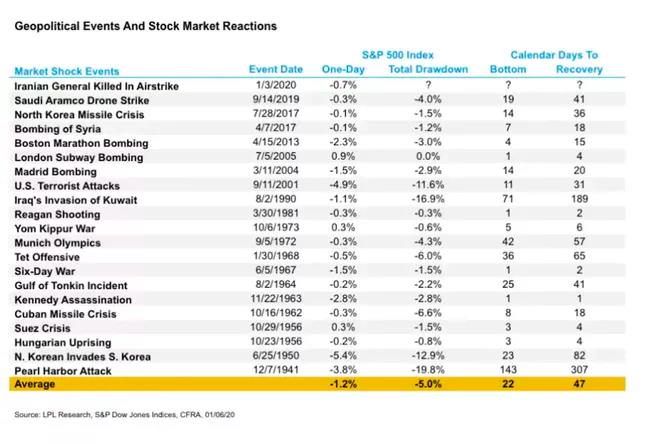

Here is a chart from LPL Financial of all our military interventions going back to Pearl Harbor (which this is not) and what happens to the stock market:

From LPL Financial research: “Stocks have largely shrugged off past geopolitical conflicts. “As serious as this escalation is, previous experiences have indicated it may be unlikely to have a material impact on U.S. economic fundamentals or corporate profits,” said LPL Financial Chief Investment Strategist John Lynch. “We would not be sellers of stocks into weakness related to this event, given stocks have weathered heightened geopolitical tensions in the past.”

Having said that, the Ukraine tensions will likely send energy prices higher in the short-term (which are already high as the forces of demand from re-opening economies and supply still coming back on-line re-balance), but given that 1/3 of Russia’s economy is dependent on energy, they are not likely to choke off supply to Europe (Germany the big one).

Higher energy costs hits consumers’ pocketbooks, though so far, there is little evidence of reduced consumer spending – some 2/3 of the US economy — and oil prices have been high for a while.

We at Bd8 Capital Partners would stay the course, and not sell into weakness. We are positioned for long-term success, and stock volatility is a normal and relatively frequent part of stock investing. Risk is really about risk of capital loss, not the volatility inherent in stock prices. We are invested in companies that should deliver good returns over the longer run.

Please contact us to discuss further if you like.

Best,

Barb

Barbara Doran

CEO CIO

bdoran@bd8cap.com

linkedin.com/in/barbara-doran-7aa248

https://twitter.com/barbara_doran1__

BD8 Capital Partners LLC

Cell: 917-733-7644

Fax: 917-580-6882

The content of this article is for informational purposes only and should not be considered a recommendation of any particular security, strategy, investment product or investing advice of any kind. There are risks associated with investing, including the entire loss of principal invested. Past performance does not guarantee future results. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the opinions of Spire Wealth Management, LLC, Spire Securities, LLC or its affiliates. Spire Wealth Management, LLC is a Federally Registered Investment Advisory Firm. Securities offered through an affiliated company, Spire Securities, LLC a Registered Broker/Dealer and member FINRA/SIPC.

PLEASE READ THIS WARNING: All e-mail sent to or from this address will be received or otherwise recorded by Spire’s corporate e-mail system and is subject to archival, monitoring and/or review, by and/or disclosure to, someone other than the recipient. This message is intended only for the use of the person(s) (“intendedrecipient”) to whom it is addressed. It may contain information that is privileged and confidential. If you are not the intended recipient, please contact the sender as soon as possible and delete the message without reading it or making a copy. Any dissemination, distribution, copying, or other use of this message or any of its content by any person other than the intended recipient is strictly prohibited. Spire has taken precautions to

screen this message for viruses, but we cannot guarantee that it is virus free nor are we responsible for any damage that may be caused by