Despite a summer rally that erased more than half the losses of the first half of this year, raising hopes that inflation had peaked and the bear market was over, the S&P 500 and Nasdaq composite ended the third quarter down more than in the first half: the S&P 500 was off 23.87% from the beginning of the year and Nasdaq, -32%. (They are both marginally better as of this writing at -20.25% and -30.16% respectively.)*****

Inflation and the Fed’s determination to rein it in by raising interest rates to slow the economy continue to be the dominant theme: having raised interest rates a full 3 percentage points so far this year, the Fed is widely expected to raise rates again at both their November and December meetings.

Despite the evident impact of higher rates, think housing and the 30-year mortgage rate at near 7% (vs.3% at the start of the year)– the toppling of commodity prices and the continuing decline in manufacturing*, consumer demand has continued to hold up, as jobs are plentiful, wages are strong,

and consumer balance sheets were de-levered during the covid shut-down crisis.

Recent inflation measures have not confirmed the softer inflation numbers of the summer, leaving investors cautious and uncertain as to when and how quickly inflation will roll over and the continued unknown impact on corporate earnings: hence, the continued roiling of the equity (and bond) markets.

Bonds have not been the safe haven they often are when stocks are underperforming; indeed, the investment grade bond ETF, iShares iBoxx $ Investment Grade Corporate Bond, is down 25% YTD.

What now? Until we still evidence of a sustained drop in inflation, the Fed has promised to keep raising rates – despite increasing investor worries that given the lagged impact of rate hikes, the Fed may go too far in weakening economic growth. That means continued volatility and likely opportunities in stocks as investors assume worst case, sell on fear, driving some stock prices below fair value.

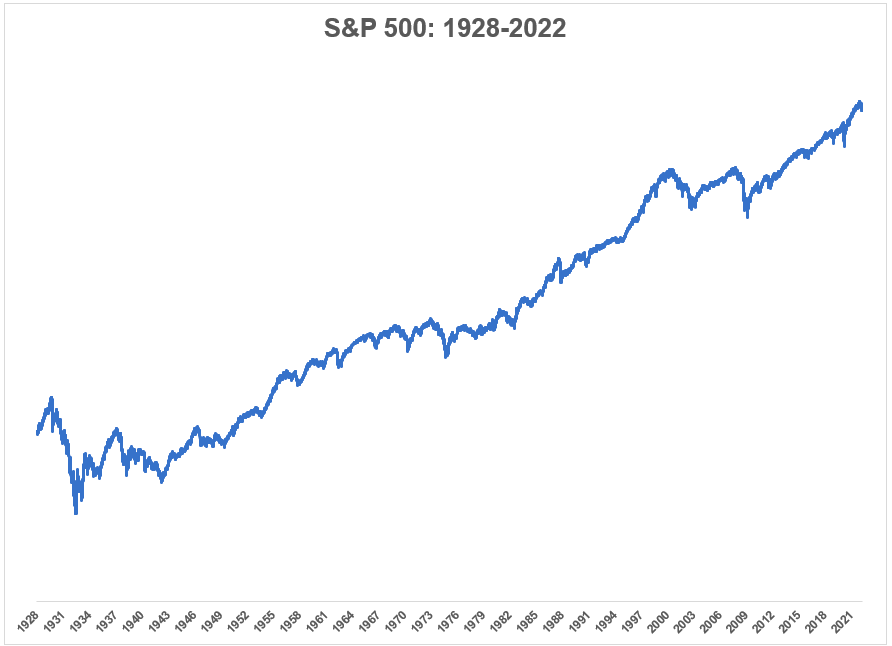

There has never been a bear market from which the stock market did not recover and return to its previous peak**, usually within a few years and often much sooner.The long-term trend in the stock market has historically been up: it is never a straight line, but since 1928, the US stock market performance has averaged +9.8% per year.

Going back to the late 60’s, the average bull run is six years with an average cumulative return of over 200%. The average bear market has lasted roughly 15 months, with an average loss of 38.4%.***

Going back even further, since World War II, there have been 12 bear markets with an average decline of 32.5% lasting on average 14.5 months.****

Market rebounds tend to be front-loaded and missing those days can have a big impact on performance. Half of the S&P 500’s strongest days in the last 20 years were during a bear market. Another 34% of the market’s best days happened in the first two months of a bull market – before it was clear a bull market had started.***

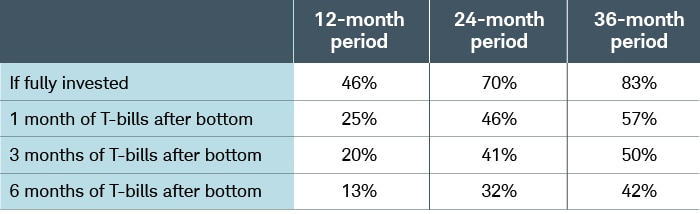

Market timing seldom works; while it is hard to watch portfolios dips with the market, these downturns have always been a temporary part of the process. In fact, of the 92 years of stock market history, stocks have risen 78% of the time. Schwab did some interesting work to show what can happen if you pull out of the market, even temporarily, during the average bear market:

As you can see in the table below, the all-stock portfolio was the best performer and was still delivering higher returns than the other portfolios three years after the market bottomed. But investors in that all-stock portfolio had to stay invested at literally the lowest point of the market cycle. Those who waiteduntil the skies were clearer (e.g., a month after the low point of the cycle, or three months, or even sixmonths) still participated in the recovery. They just earned lower returns. Cumulative return following bear market

At BD8 Capital Partners, our portfolios are positioned for the long-term, with investments in well-run companies that are leaders in their industries with long trajectories of growth ahead, whose fundamentals should support stock price appreciation over time, despite near-term uncertainties.

We continue to focus on your financial planning and investment needs and have an audited track record to back up our unwavering commitment to your financial health and well-being.

Please don’t hesitate to contact us with any questions and concerns.

Best always,

Barb

*ISM

**Investopedia

***Schwab Research

****Ned Davis Research

***** Envestnet

Barbara Doran

CEO CIO

BD8 Capital Partners LLC

Cell: 917-733-7644

Fax: 917-580-6882

bdoran@bd8cap.com

linkedin.com/in/barbara-doran-7aa248

https://twitter.com/barbara_doran1__

The content of this article is for informational purposes only and should not be considered a recommendation of any particular security, strategy, investment product or investing advice of any kind. There are risks associated with investing, including the entire loss of principal invested. Past performance

does not guarantee future results. The views and opinions expressed in this article are those of the

authors and do not necessarily reflect the opinions of Spire Wealth Management, LLC, Spire Securities, LLC or its affiliates. Spire Wealth Management, LLC is a Federally Registered Investment Advisory Firm. Securities offered through an affiliated company, Spire Securities, LLC a Registered Broker/Dealer and member FINRA/SIPC.

PLEASE READ THIS WARNING: All e-mail sent to or from this address will be received or otherwise recorded by Spire’s corporate e-mail system and is subject to archival, monitoring and/or review, by and/or disclosure to, someone other than the recipient. This message is intended only for the use of the person(s) (“intended recipient”) to whom it is addressed. It may contain information that is privileged and confidential. If you are not the intended recipient, please contact the sender as soon as possible and delete the message without reading it or making a copy. Any dissemination, distribution, copying, or

other use of this message or any of its content by any person other than the intended recipient is strictly prohibited. Spire has taken precautions to screen this message for viruses, but we cannot guarantee that it is virus free nor are we responsible for any damage that may be caused by

Barbara Doran

CEO CIO

BD8 Capital Partners LLC

bdoran@bd8cap.com

https://www.linkedin.com/in/bd8cap/

https://twitter.com/barbara_doran1

Cell: 917-733-7644

Fax: 917-580-6882

Courtney Smith

Lead Client Service Associate

Courtney.smith@bd8cap.com

Office: 332-220-3922

PLEASE READ THIS WARNING: All e-mail sent to or from this address will be received or otherwise recorded by Spire’s corporate e-mail system and is subject to archival, monitoring and/or review, by and/or disclosure to, someone other than the recipient. This message is intended only for the use of the person(s) (“intended recipient”) to whom it is addressed. It may contain information that is privileged and confidential. If you are not the intended recipient, please contact the sender as soon as possible and delete the message without reading it or making a copy. Any dissemination, distribution, copying, or other use of this message or any of its content by any person other than the intended recipient is strictly prohibited. Spire has taken precautions to screen this message for viruses, but we cannot guarantee that it is virus free nor are we responsible for any damage that may be caused by this message.